|

LAST CHANCE TO

ENTER OUR READERS COMPETITION:-

"Britain's Favourite Circus goes off-the-scale wild in its latest

creation!"

LAST

week we told you all about the

fantastic news that Zippo's Cirque Berserk will be in Southport over

Thursday, 30 January to Saturday, 1 February 2013, with a show that

mixes contemporary "cirque" style skills with off the

scale thrilling stunt action!

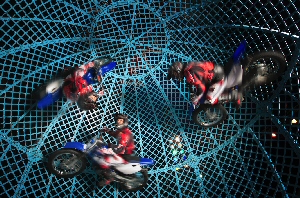

The Cirque

Berserk show has the

world's most dangerous circus act, the legendary Globe of Death,

with 3 motorcyclists speeding around inside a steel cage at over

60mph, seen for the 1st time live on stage in the UK... So it is no

wonder why it has had not 1, but 3 sell out seasons in London's Hyde

Park Winter Wonderland.

The show also will consist of over

30 jugglers, acrobats, aerialists, dancers, musicians and death

defying stunt men, joined by Guinness World Record holding strong

man Hercules and award winning clown Tweedy.

The show also will consist of over 30 jugglers, acrobats,

aerialists, dancers, musicians and death defying stunt men, joined

by Guinness World Record holding strong man Hercules and award

winning clown Tweedy.

Cirque Berserk will be on stage at the Southport Theatre for just 3

days from, Thursday, 30 January 2013 to Saturday, 1 February 2013.

The shows are on:- Thursday, 7.30pm, Friday, 5pm and 7.45pm,

Saturday, 2.30pm and 7.30pm. Ticket prices are:- £24.00, £21.00 and

£18.00 and general concessions get:- £5 off. Booking is open now

at:- 0844 871 7646 (bkg fee) or online at:-

atgtickets.com/southport.

But YOU could see the show

FREE and win a unique prize; just enter our

READER COMPETITION!

The winner can choose either:-

A) Beautiful model Musical Box Big Top; a valuable collectors' item

to cherish (retail value £160) + 4 tickets for Cirque Berserk

or

B) An unique photo opportunity for yourself and a friend to stand

inside the motorcycle Globe of Death before a performance and have

your picture taken with the dare devil riders of the Lucius Team on

their stationary machines. Plus 4 tickets for Cirque Berserk.

Just answer this simple question:- "Who are the dare devil

riders inside the motorcycle Globe of Death at Cirque Berserk? "

Send your answer to:-

news24@southportreporter.com to arrive by the closing

date of 12 noon on Thursday, 9 July 2014.

Don't forget to include your full name, full address and a phone

number!

ZIPPO'S CIRCUS WILL NOTIFY WINNERS AND WILL ARRANGE THEIR PRIZE

SEATS SUBJECT TO AVAILABILITY. THE ORGANISERS' DECISION (ZIPPO'S

CIRCUS) IS FINAL. SOUTHPORT REPORTER TERMS AND CONDITIONS ALSO APPLY

DATA PROTECTION NOTE:- IT IS A CONDITION OF ENTRY THAT COMPETITORS

PERMIT THE CIRCUS TO HOLD THEIR CONTACT DETAILS; THOSE DETAILS WILL

NOT BE PASSED TO ANY THIRD PARTY, BUT ZIPPO'S CIRCUS MAY SEND

ENTRANTS PROMOTIONAL MATERIAL.

A North West New

Year's Resolution for more jobs and better wages

WAGES and Jobs will remain

the 2 big barriers to recovery in the North West on 2014, say the

TUC's Regional Secretary Lynn Collins. Having took up post a

year ago, Lynn has seen small signs of improvement in the economy

and a welcome growth in jobs, but says more needs to be done in the

new year to get us back on track including tackling the living

standards crisis, in the region, wages have failed to rise in line

with inflation for 5 years now and any increased spending that has

happened has come from people eating into family savings.

Lynn Collins says:- "The statistics show that Britain's

economic recovery is real but that is not how it feels here in the

North West. This is because the government has failed to deliver a

growth strategy based on rebalancing the economy through exports and

investment. Instead growth is coming from rising house prices and

people running down their savings. And while jobs growth is welcome,

too many jobs are insecure and combine the three lows: low skill,

low productivity and low pay."

Having reflected on what has gone on so far, Lynn highlights the

campaign for workers to receive a "Living Wage" and

the need to outlaw the use of 0 hours contracts as 2 key campaigns

for 2014. Lynn says:- "We have heard a lot about food banks

and their growth in our region, and whilst there is an assumption

they exist for those on benefits, we know that over the last year

the biggest rise in food bank usage is by those in work, and facing

low wages and no guaranteed hours."

Lynn says that this is down to employers choosing to pay low wages,

despite the call for them to share rising profits. This also comes

on the back of this announcement that the director general of the

CBI, John Cridland, has called on businesses to share their wealth.

"It's a disgrace that workers have to turn to charities to put

right the damage caused to working families by low wages. Paying a

decent wage to all workers would reduce not only food bank

dependency, but the benefits bill which currently tops up household

income for those in low paid work. Employers should take

responsibility and pay decent wages and this will be a big area of

campaigning over the next 12 months."

Lynn also welcomed recent announcements about jobs growth in the

region, including the increase in apprentice opportunities announced

today by British Aerospace. "Getting our young people in to

decent work will be the biggest long term boost to the North West

Economy. Youth unemployment remains a huge problem in the region,

and it's vital we don't leave this generation of young people

behind. We want to work with employers to ensure we create real

opportunities young people to work and learn, and to create real

jobs for them to go to. Without tackling the dual problems of wages

and jobs, we won't see the benefit of any recovery for many years to

come. This is why 2014 will be a crucial year. It will be dominated

by a single political question – whose growth? That reflects the big

divide that is opening up about what future Britain should have. Do

we want to go back to a business as usual version of the pre-crash

economy, based on housing bubbles, an over mighty finance sector and

increasing inequality as a growing proportion of the workforce fail

to share in prosperity? Or do we want to build a new, genuinely

rebalanced economy that through investment, growth and active

government aims for a high skill, high pay, and high productivity

economy that shares out prosperity to all? I know which side trade

unions are on here in the North West."

|

|

Nearly 700 tax

criminals convicted in 2013

ALMOST 700 tax fraudsters

and benefit cheats were convicted this year, HM Revenue and Customs

(HMRC) has been announced to the press at the start of 2014.

Between January and the end of November, HMRC investigations led to

690 successful convictions; up from 477 in 2012, and the highest

since the 2010 Spending Review. These convictions led to sentences

totalling 355 years in prison. The investigations covered

everything from complex VAT, income tax and benefit frauds to

smuggling cases. HMRC is also publicising the top 5 tax cheat

prosecutions of 2013, who between them share a combined jail

sentence of over 75 years, on its Flickr

gallery.

Exchequer Secretary to the Treasury David Gauke said:- "The

Government is determined to make sure people pay the tax they owe

and HMRC will come down hard on those who try to cheat the system.

Honest taxpayers will be pleased that these fraudsters are now

paying for their crimes. We have invested nearly £1 billon in HMRC

to tackle those who fail to play by the rules, and these figures

clearly demonstrate that investment is paying off."

Donald Toon, Director for Criminal Investigations at HMRC, said:-

"These convictions send a clear message that tax fraud will not

be ignored and tax fraudsters should be very concerned. We are well

on track to achieving our spending review commitment to increase the

annual number of prosecutions to over 1,000 by 2014/15. The vast

majority of people are honest with their tax affairs, but if anyone

knows of somebody evading their taxes they should call HMRC and tell

us."

Tell HMRC about customs or excise fraud, or tax evasion, at:-

hmrc.gov.uk.

Revenue reveals

'Top 10 oddest excuses' for late tax returns

WITH the 31 January 2014

tax return deadline just around the corner, HM Revenue and Customs (HMRC)

has revealed the 'Top 10 oddest excuses' for sending in a late

return.

The following bizarre, exotic and flimsy excuses have all been used

by tardy taxpayers:-

1. My pet goldfish died (self-employed builder);

2. I had a run-in with a cow (Midlands farmer);

3. After seeing a volcanic eruption on the news, I couldn't

concentrate on anything else (London woman);

4. My wife won't give me my mail (self-employed trader);

5. My husband told me the deadline was 31 March, and I believed him

(Leicester hairdresser);

6. I've been far too busy touring the country with my one-man play

(Coventry writer);

7. My bad back means I can't go upstairs. That's where my tax return

is (a working taxi driver);

8. I've been cruising round the world in my yacht, and only picking

up post when I'm on dry land (South East man);

9. Our business doesn't really do anything (Kent financial services

firm); and

10. I've been too busy submitting my clients' tax returns (London

accountant).

All of these people and businesses received a £100 penalty from HMRC

for filing late. They appealed against the decision using these

excuses, but were unsuccessful.

HMRC's Director General of Personal Tax, Ruth Owen, said:-

"There will always be unforeseen events that mean a taxpayer could

not file their tax return on time. However, your pet goldfish

passing away isn't one of them. If you haven't yet sent your 2012/13

tax return to HMRC, you need to do it online and pay the tax you owe

by the end of January. With all the help and advice available,

there's no excuse not to."

To send an online tax return, you must be registered for HMRC Online

Services. This involves HMRC sending you an Activation Code in the

post, so allow a few days for this to arrive. To register for HMRC

Online Services go to:-

hmrc.gov.uk/online and follow

the on-screen instructions.

For general help and advice on completing a return, visit:-

hmrc.gov.uk/sa or call the Self

Assessment helpline on:- 0300 200 3310 (open 8.00am to 8.00pm,

Monday to Friday, and from 8.00am to 4.00pm on Saturdays).

Did you know that:-

1. Around 10.9 million people are expected to fill out a Self

Assessment return for the 2012/13 tax year.

2. The penalties for late Self Assessment returns are:-

► An initial £100 fixed penalty, which

applies even if there is no tax to pay, or if the tax due is paid on

time;

► After 3 months, additional daily

penalties of £10 per day, up to a maximum of £900;

► After 6 months, a further penalty of 5

per cent of the tax due or £300, whichever is greater; after 12

months, another 5 per cent or £300 charge, whichever is greater.

3. There are also additional penalties for paying late of 5% of the

tax unpaid at:- 30 days; 6 months; and 12 months.

NEXT OF KIN

APPEAL - DAVID HARTLEY, SEFTON

SEFTON Coroner's Office are

appealing for the public's help in tracing the next of kin of David

Hartley, from Southport, who died on Sunday, 29 December 2013. Mr

Hartley died in his home on Pilkington Road and his death is not

being treated as suspicious. Mr Hartley was 81 years old and he is

believed to have connections to the Lancashire and Cumbria areas.

Mr Hartley's family, or anyone who

knows them, are asked to call Sefton Coroner's Office on:- 0151 777

3481.

|