|

Tens of thousands ring

in the new year by submitting Tax Returns

A record breaking 24,546 people

submitted their Tax Return online on New Year's Eve, HM Revenue and Customs

(HMRC) has revealed. These shocking figures which have just been released by

HMRC show a 2.8% rise on 1 year ago, while more than 11,467 people sent off

their Self Assessment Tax Return on New Year's Day 2016 itself. Does this

show that people now have to put more time into paperwork and have less time

for social life and holidays than before?

HMRC said that hundreds of people decided to spend the 1st hours of 2016

completing their Self Assessment, with more than 600 people submitting their

Tax Return between midnight and 10am, on New Year's Day. To some, this shows

just how bad the UK is becoming, and that issues like the worry about

submitting Tax Returns are just added pressure on people already hard pushed

to get time to do personal things. This could help to explain some of the

issues of social breakdown and increasing levels of depression and anxiety

levels seen by the NHS.

The data also shows that the number of people completing their Tax Return on

Christmas Day broke records, with 2,044 customers as well, an increase of

13% on 25 December 2014. Again this high level could indicate that higher

levels of financial and Government paperwork is interfering with essential

leisure and relaxation time, and adding yet another element of stress to

people's already overburdened lives, allowing less time for religious

expression, family life and social life, much to the detriment of society as

a whole. 1 agency expressed the opinion that we now face a veritable

monsoon of paperwork which many are not equipped to handle, thus mistakes

and omissions are inevitable. Once upon a time the general public submitted

their relevant data and this was entered by those best equipped to deal with

the material, leaving that the majority free to deal with what they were

more suited to. Now most people are assumed to understand the mind boggling

mass of data the powers that be feel it necessary to amass, with sometimes

dire consequences.

On Boxing Day, 5,402 customers ignored the temptation of the sales and

instead chose to find their inner peace by completing their Self Assessment

online. This to some could also indicate that paperwork could be damaging

the economic recovery of the UK!

Ruth Owen, Director General of Personal Tax, HMRC, said:- "As we all

enjoy the festive season it's easy to see how completing your Tax Return can

be forgotten, but the 31 January deadline will be here quicker than we

think. Our advice is, don't leave it until it's too late. Make sure you give

yourself plenty of time and remember our online service is available with

helpful advice and handy tips any time of the year, whether that's on

Christmas Day, or even New Year's Eve."

The deadline for sending 2014 to 2015 Tax Returns to HMRC, and paying any

Tax owed, is 31 January 2016. If you do not supply, you will be hit with the

£100 automatic penalty for late filing.

The £100 automatic penalty for late filing has been particularly criticised

because since 2012 it affects people even if a UK Citizen is not even liable

for any Tax. In 2015, it was reported that about a quarter of people who had

to fill in Self Assessment Returns had no liability or owed less than £50.

Yet, if they got their returns in too late they would, and did, get fined!

Back in May 2015, many charities blasted the automatic £100 fine for late

Tax Returns as:- "nothing short of oppressive". At that time,

HM Revenue and Customs was asked by many charities to overhaul the

controversial penalties said to have been imposed on nearly 1m people a

year. Sadly, HMRC still have not put in any form of support in place, even

if someone had missed the deadline because of serious illness or bereavement

and can prove it. So many charities have pointed to these figures as a

direct evidence of factors causing the fear of being powerless to prevent

being fined. "These results should not be shown in a good light. HMRC

is adding huge pressure on people who are often at breaking point. Many

people find these forms hard to fill in and cannot afford professional

advisers. If they make an error, even if they do not have any Tax to pay,

they can and will be fined! Last year about 200,000 people last year missed

the deadline because they failed to press the "submit" button when they

filed online. Other issues have also highlighted the problems with this

system. This pressure is destroying our society and people's lives!"

said groups like the Low Incomes Tax Reform

Group.

This is compounded by the fact that errors made by HMRC do not appear to be

dealt with any degree of urgency and people may be forced to wait a

considerable time before their problems as addressed, let alone

satisfactorily resolved. Accusations of buck passing have been made by many

public bodies of late.

So do you think HMRC should celebrate the fact people fill in Tax Returns

over the festive season or not? Do you think our Government should

take a step back and take a look at the system, or do you think it is

correct that people are fined, no matter what...? Please email us to:-

News24@SouthportReporter.Com.

If you need help with your Tax and can't afford help, go to Bridge The Gap,

who are a free Tax Advice service for people in the UK.

You can find out more about them via going to:-

Bridge-The-Gap.Org.UK.

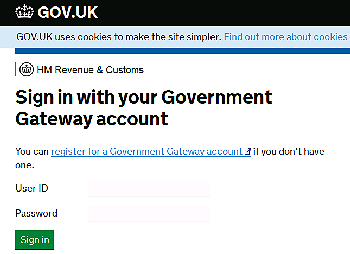

The help page for HMRC can be located at by clicking on

here.

|